Bursting Bubbles: AI Financial Engineering

How we grow up and blow up our economy courtesy of AI.

“All human development must be outside the rules; otherwise we would never have anything new.” - Charles Kettering.

Here we are going to look at the evolution of financial engineering and the weird, wonderful and volatile places it is going to take us.

If you are an investor, builder, or anyone with money, this is somewhere you will want to get up to speed because…

TLDR: Financial engineering is only going to get crazier (especially with AI and crypto), and if you don't understand it, you will get left behind.

Table of Contents:

The introduction: what is financial engineering (FE)?

The history of FE: defined by increasing complexity and the ability to increase shared risk.

The present of FE: the current landscape is defined by corporate debt and automation.

The future of FE: crypto will allow hyperflexible financial engineering and AI will accelerate automation into delegation. And an example of what this looks like.

1. The Introduction:

Business has always been a race; who can expand the fastest without taking too many risks and crashing. But how to win? That is the (evolving) question!

Practically, much is known: have a great product at a good price, hire a great team, and, more importantly now than ever, tell a (very) great story.

But this is the bare minimum. It's becoming increasingly clear that if you're not at the forefront of making the most out of your money, then none of the above will even matter.

What even is financial engineering?

In its modern form, it is the process of using maths, stats and computers to solve financial problems, create new products and grow businesses.

In the same way that structural engineers improve buildings so that they can be bigger and better (without falling over), financial engineers improve business structures so that they can do more with less money.

I get it, it sounds risky. So did getting on a plane in 1915; now we have 100k commercial flights per day. Engineers improve the odds of taking risks and allow us to expand.

But that doesn't mean the structures don’t occasionally come crashing down.

In the early 2000s, banks started giving more and more risky housing loans, and then, using the financial engineering of the time (mortgage-backed securities), packaged them up into tradable items and sold them. This worked for so long because no one really understood what was going on. But eventually, when the housing market stalled and people couldn't pay back the debt, we had the 2008 big bust (GFC) that got Margot Robbie into a bathtub.

Not great for the financial engineering reputation, but that, as we will see, has definitely not stopped us, and as you will read right at the end, may be only the tip of the iceberg.

However, all these structures don't just emerge at once; financial engineering has undergone many incremental improvements before reaching its modern form.

Let's take a look back at the old balance sheet engineers.

2. The History of Financial Engineering

All this engineering does at a high level is allow more shared risk and reward; people can share in the upside of others through more complex instruments (increasingly leveraged) as long as they take on some of the risk.

So, as financial engineering becomes more complex, people have been able to do exponentially more with their money. And as students of history will realise that those who weren't financially innovative got left behind, modern companies will naturally start to push boundaries.

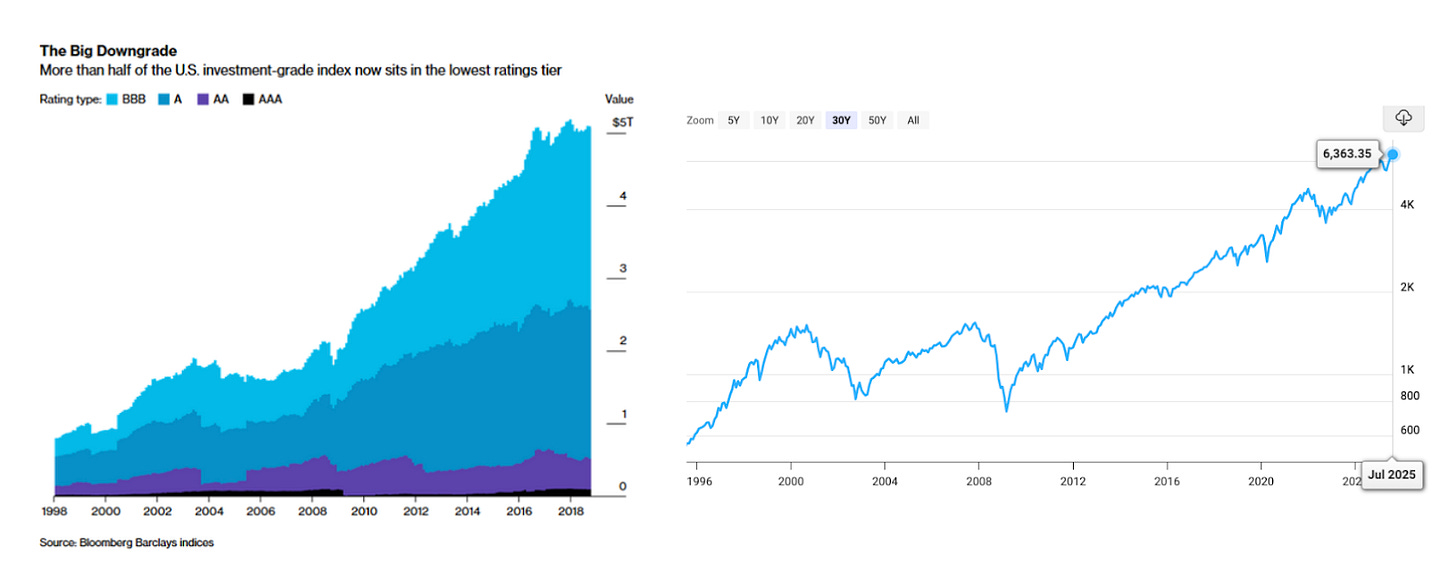

The rate of increase in financial engineering can be seen in many ways, but here we will be looking at two main hallmarks: debt and automation.

First, at the current state of affairs (3) and then below (4), through a mixture of crypto and AI, how the future will become even crazier.

3. The Present of Financial Engineering

More Automation

We are on a mission to automate (make ourselves redundant) in almost every sphere, and nowhere more so than in finance.

Computers and big data have enabled the modern financial system to evolve into a web of code that very few can explain.

It's also not just the automation of trading strategies; algorithms have been replacing decision-making in finance for decades, whether it's determining who gets a loan or insurance, which stock to buy, or which funding option to choose. Easy.

Of course, like anything automating there are good and (potentially) bad things.

Good: all of this allows us to build more and more functionality (and manage risk) into financial markets, and it's not just for fun; fees are charged in finance for extra complexity.

Bad: risks can become so complex and interwoven that fewer and fewer people understand what is actually going on (more on this below).

More Debt

In addition to the automation, which helps us manage all this complexity, we are getting stupidly good (or bad) at borrowing from the future to pay for the present.

Drumroll plz: we live in the biggest debt era the world has ever seen.

Whether it's at the household, nation-state, or corporate level (as shown above), more credit has become the main driving force behind expansion rather than sustainable growth.

Low interest rates have played a part, but due to new types of financial engineering (LBOs, CDOs, SPVs, CLOs, ABSs - you name it), corporate balance sheets have never been more flexibly leveraged.

As to what this money is being used for: most was cited for longer-term growth plans, but has instead been spent on short-term trinkets to satisfy investors (stock buybacks and flashy M&A). Realistically, the answer is… why wouldn't you take the money (especially if everyone else is racing to).

Regardless, people are starting to notice.

But even as investors see the ratings agencies question the stability of the debt, they just can't help from piling in. Such is the nature of an asset class fueled by debt and an inflating denominator. But as the saying goes, nothing stops this train. But maybe we can even speed it up? (See below).

And that's just in public markets. There are more options for engineering debt than ever before in private markets.

Many are using this private capital (funded from banks) to pay for the AI data centre boom. Not problematic now, as this type of debt takes a while to show up on the balance sheet. But if AI doesn't pay for itself relatively soon, there could be issues (dot-com bubble 2.0?).

Anywho, it’s best not to get lost in the details.

These only serve to prove the wider point that financial engineering in its present form (especially through debt and automation) is giving the market room to grow without necessarily growing.

So (amongst other reasons) while this financial engineering expands, markets can continue to trade further and further away from reality (earnings) at quite a rapid rate.

How far can they go? Well, taking the Tech Bubble (1998-2002), the GFC (2008) and the COVID pump (2020), there is certainly precedent for higher… err how?

Let’s have a look at what might be in store.

4. The Future of Financial Engineering

Although a decent amount of guesswork is needed to predict the exact form of future financial engineering, the overarching trends seem pretty obvious. Just as the past and the present have achieved more venues for shared risk and reward through debt-like instruments and automation, so too will the future, through crypto and AI.

Even More Debt and Shared Risk

Whilst I have no doubt that the traditional markets will come up with other new 3-letter ways to financially engineer even more debt. The one realm that has seen major innovation in recent years is decentralised finance (DeFi).

If you are new to DeFi, please see here.

As a quick recap, DeFi is essentially software-based financial infrastructure that better connects global parties with less middlemen (peer-to-peer) and fees. In other words, modern digital finance for ALL the people, by the people (at least that is the dream).

In this vein, much of what currently exists in traditional finance (borrow/lend, derivatives, trading) is copied into cryptoland to provide the same service but with different principles, less fees, and more speed. But due to some of those core principles (permissionless, open-source, [relatively] transparent), the design space is a lot more open and novel primitives for financial engineering are beginning to pop up.

The first early example has been through listed corporations acquiring cryptoassets on their balance sheets (DATs).

E.g., Bitcoin treasury companies have acquired 3.64% of the BTC total supply by raising $3.35b in preferred equity and $9.48b in debt and are trading at a 73% aggregate premium of their BTC holdings.

Many of them acquire the assets with very different risk profiles; some simply acquire spot cryptoassets, and others are far more engineering-heavy.

For example, there are now 7 different ways and counting to help MicroStrategy acquire leveraged BTC, and this is just the start of a much broader movement. Taking it even further, other corporations are using their BTC to borrow even more cash to buy businesses, and even specific FOFs are being raised to target these opps. We will see how long these structures last.

Most see them for what they are: a party you really can't miss, but don’t want to be the one mopping up the greed-fueled puke from the floor. Timing is of the essence.

Regardless, these shenanigans are not that new; this happened with SPACs, and there are strong similarities with the investment trust railroad boom.

But it is the start of something much bigger: the adoption of novel primitives to expand our scope of financial engineering.

As we have seen above, access to debt is very important and as an example of novelty that can be provided crypto has many new alternatives: over (AAVE) and undercollateralised lending (Maker CDPs), flash loans (Morpho), debt sharing (Liquity), synthetic stablecoins (Ethena), liquid staking derivatives (Lido), restaking (Eigen), zero-knowledge credit (Worldcoin), tokenised debt (Maple), onchain credit (Securitise) to name a few.

Many will say these are just circle-jerk nonsense finance, but this is because the plumbing has been built without the water. Now, as you can see above, the ‘real world asset’ taps are being turned on.

But crypto will do a lot more than just repackage debt. Perhaps the biggest and simplest unlock is the supercharging of more shared risk and reward.

As anything can be tokenised (rent, royalties, electric vehicles, attention) and accessed by anyone with an internet connection, the possibilities for shared enterprise are even wider. There are already examples from business, war, charity, culture, and science. And due to the composable and automated nature of this new digitally native financial system, the weird and wonderful financial engineering built on top can get pretty mad.

Example: Want to build an EV battery charging station in South Korea, fundraised by selling tokenised asset-backed securities to a bunch of non-KYCd but ZK-credit-scored randos living in Lagos and St Petersburg with different tranches of autostreamed cashflows with variable rates? Sure, and in your spare time, sell spare EV capacity through a DeFi vault that arbitrages grid demand across time zones.

Do you need to do that? Well, if you don’t, you may just get left behind.

All very exciting. But at the end of the day, crypto will just be a venue and eventually a backend one, despite being an essential ingredient.

Let's instead look at who might be using it.

Automation → Delegation

Once you have a digitally native financial system that is getting increasingly complex, what (or who) are we going to get to manage it for us?

Although bigger firms have been using AI in finance for decades, the rest are only just catching up:

>90% of Fortune 500 companies have filed at least one AI-related patent since 2020, and AI patents in algorithmic trading have risen from 19% (2017) to >50% each year since 2020.

86% of hedge fund managers now use AI tools for research, coding and operations.

By 2021, 56% of hedge funds were actively using machine learning models for trading decisions.

Much of this financial activity will fall under the category of general automation, such as improving risk management and spotting patterns in data that humans can’t. But this is all a given, not that interesting, and although people are getting over their skis on timelines, almost everyone agrees that we are just scratching the surface of what these models can do.

Over time, firms will naturally push boundaries because if everyone has an edge, then no one does.

There have already been early indications of breakthroughs in the speed and understanding of advanced maths and other fields, such as quantum AI (LQMs), which may give us a whole new set of financial services.

Again, this is not without risks. Money will be lost and won as it becomes a data and processing battle (forget trading against Citadel + OpenAI), and herd mentality with AI means that markets will become more intertwined.

But the types of risk ultimately depend on the level of delegation.

If we use AI to create complex, interwoven webs of financial engineering using languages and mathematics that we have never even heard of, we won't be able to fully see the risks until they happen. Even then, we can't fix something we don’t understand.

Of course, this all may never happen - AI might just be quite average. If you can learn one thing from doomer predictions like Eliezer Yudkowski’s imminent extinction ideas, it's that it’s most likely that these changes happen so slowly that we barely notice.

But delegating autonomy is regressive. As you give incrementally more away, your financial (or general) illiteracy becomes harder to diagnose and even harder to cure. What's worse, you probably won't even want to.

Is this all bad though? Of course not. Perhaps the gains from AI can bridge the horrendous gaps between debt-to-GDP and price-to-earnings. I remain suspicious.

Perhaps we even return to our classic Greek roots, and finance bros (or AI agents) are viewed as usurious slaves. But as I wrote elsewhere, this cannot scale to everyone, as it's hard to paint a fresco when you live under a bridge.

But in reality, I think we have a lot weirder to go in financial markets.

What could this actually look like?

Building on the shoulders of all the financial engineering that has come before us and bringing together the two more recent themes above:

The era of internet finance is accelerating (new primitives creating access to any kind of market for anyone).

The machine economy is coming (AIs making many decisions in markets).

We will see types of financial engineering and assets that we have never seen before.

For Example: You are the CFO of a big data centre corp, and as demand for compute explodes, you ask GPT 7 to structure up some tidy options for expanding operations rapidly. 47 seconds later, the compute-backed token (CBT) is born as a means to raise money against future GPU capacity. Data centre operators everywhere start borrowing heavily to build.

Here the real fun starts…

The banks begin repackaging the CBTs into Compute-Backed Securities (CBSs) in various risk tranches.

Hedge funds leverage CBS holdings to borrow cash, using the tokens as collateral in both traditional repo markets and on-chain lending protocols.

Coinbase, Robinhood, and WhatsApp offer 12–15% on their new combined stablecoin product USDCOM (backed unbeknownst to retail through CBTs). Encouraged by Apple and their new sponsored affiliate program, all personal AI agent money managers recommend this as 10% of people’s savings.

Crypto means that everyone and their granny from Montreal to Lagos can get involved in leveraged versions of these products.

The government, seeing it as strategic infrastructure, gives grants and subsidies, further juicing valuations.

Then… the shock horror happens - we don’t need that much compute in the near term. BAM. Liquidated. Evaporated. Michael Bury is finally right again, but didn’t have enough money left to short it.

An elder Margot Robbie gets back in the bath to explain the “global compute crisis” to people and their empty 401(k)s.

I imagine we have two big setbacks in the next few decades caused by this kind of financial engineering.

One, like the above that we can (already) see coming and a second, which due to the overcomplexity, will be very difficult to spot.

But this is the price of growth, and so why being a doomer can occasionally pay, I wouldn’t be short over the long term! Regardless, I will [as always] be monitoring the situation.

Welcome to the future of financial engineering.

The key takeaway here, as an investor (everyone is passive), CFO or builder, you're going to need to understand this future or you will get left behind.

Thanks to nickbtts for his edits as per!